For Some Latinx College Graduates, Student Loan Debt Is Tied to Mental Health

LOS ANGELES — The relationship between emotions and the economy are very real, especially for Latinx college graduates who carry upwards of $25,000 in college loan debt.

A new study draws on interviews from two separate data-collection periods — one in 2018 and another in 2022 — during which Latinx participants expressed a broader range of emotions, from optimism to more critical reflections on the student loan system amid the repayment pause implemented during the COVID-19 pandemic. This study particularly looks at millennials, meaning those born between 1981 and 1996.

Research findings were recently published in the journal Socius: Sociological Research for a Dynamic World. The study was led by Daisy Verduzco Reyes, Latina Futures 2050 Lab researcher and associate professor of sociology at the University of California, Merced.

“There is important research documenting the wealth gaps and student loan balance inequities between white and Black borrowers. However, we know less about Latinx borrower experiences,” said Reyes, whose last two years of research have been supported by Latina Futures, an initiative spearheaded by the UCLA Chicano Studies Research Center (CSRC). Latina Futures was created in 2022 in collaboration with the UCLA Latino Policy and Politics Institute (LPPI). Funded by a $15 million California state budget allocation, Latina Futures seeks to increase knowledge and insight through applied policy research on the contours of the economic, political, and social lives of all women and girls living in the United States over the next several decades.

According to researchers, the average millennial borrower has $33,000 in student debt, whereas the average college-graduate baby boomer (people born between 1946 and 1964) received their diploma with only $2,300 in student debt. During the student loan repayment pause, activated in 2020 and ending in 2023, an estimated 35 million Americans qualified for this relief from payments.

Other interesting findings:

- The average wealth of white families in 2022 was over $1 million

- The average wealth of Latinx families in 2022 was $227,544

- The median white borrower carries 65% of their original loan balance 12 years after graduation

- The median Latinx borrower carries more than 80% of their original loan balance 12 years after graduation

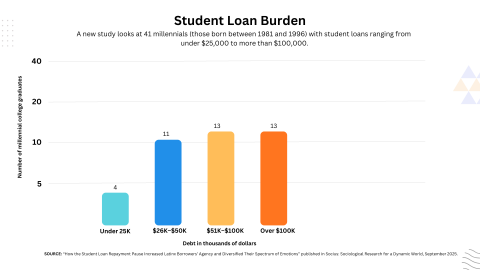

Reyes and the study’s coauthors, and Latina Futures scholars, Melissa Quesada, a sociology professor at College of the Sequoias, and Kimberly Garcia-Galvez, a graduate student at UC Merced, found that 37 of 41 interviewees carry student loan debt greater than $26,000.

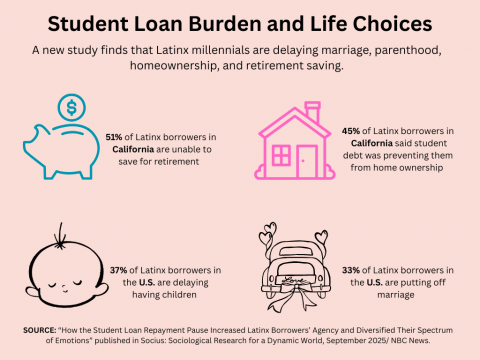

Of the 41 research participants, 26 graduated with $51,000 to more than $100,000 in debt. Respondent told researchers this debt meant they were postponing major life decisions, such as having children and being able to save for retirement. “There is a definite connection between mental health and wealth here,” Reyes said.

When researchers conducted the first set of interviews with the 41 Latinx college grads in 2018, responses regarding student loan debt tended to reflect despair and shame; in 2022 respondents said the loan pause had allowed them to pay off other expenses and, in some cases, increase their savings. Overall, research participants demonstrated improved emotional well-being.

“We have seen working class resentment mobilized successfully in our electoral politics by the right since 2016,” Reyes said. “If a Latinx middle class is to truly emerge, their fate hinges on whether and how successfully this mostly first-generation cohort of college graduates is able to benefit from their degrees—and how they feel about it. Student loan forgiveness is a significant part of this.”

XXX

Latina Futures 2050 Lab, a research initiative spearheaded by the UCLA Chicano Studies Research Center (CSRC), was created in 2022 in collaboration with the UCLA Latino Policy and Politics Institute (LPPI). Funded by a $15 million California state budget allocation, Latina Futures seeks to increase knowledge and insight through applied policy research on the contours of the economic, political, and social lives of all women and girls living in the United States over the next several decades. Follow Latina Futures on Instagram.